All advice articles

A collection of resources to aid your project

All advice articles

A collection of resources to aid your project

The pros and cons of hardwood floors

If you’re thinking of installing hardwood floors in your new conversion or extension, there are a few elements you need to consider. Hardwood floor...

Read MoreHow to pick the right materials for your conservatory

So you’re considering a conservatory, but which one is going to be right for your home? In considering this question, one of the biggest things you...

Read MoreLaminate or real wood flooring? Which is best for your house

When it comes floors, people tend to fall into two categories. Those who adore carpets, and those who can’t imagine life without a hardwood floor. ...

Read MoreHow to choose your bi-fold doors

In the last 10 years, bi-fold doors have become one of the must have features of home renovation projects. Perhaps you’ve been tempted to invest in...

Read MoreEverything you need to know before buying skylights

When it comes to getting natural light into your home, who doesn’t love a good skylight? Compared to glass ceilings, they’re a cost effective way t...

Read MoreA guide to structural glass and your extension

You might have spotted structural glass on either Grand Designs or in the pages of architectural magazines. It’s a popular material for making stun...

Read MoreOak framed vs brick extension - which is best?

When it comes to building your home, making sure it stands up is a big priority. But what frame you buy is a question very much in the air. Do you...

Read MoreMyths about timber framed extensions

Unlike our Scottish counterparts, timber has never quite taken off in the rest of UK homes. Until now, that is. With more homeowners than ever tur...

Read MoreSustainable construction: alternative building materials

Sustainability is something we are encouraged to think about in every aspect of our lives. As the UK’s leading residential architectural practice, ...

Read MoreHow to choose internal flooring for your extension

Internal flooring might feel like a finishing touch for your house extension or loft conversion, but it’s worth starting to think about it early in...

Read MoreDo you know the cost of glazing?

Put simply, double glazing involves two panes of glass separated by a vacuum or inert gas (What’s that, you ask? Check our handy glossary for compl...

Read MoreIs stone flooring right for your home?

Full of character, highly durable, and with plenty of options available - is it any wonder so many homeowners dream of stone flooring? However, sto...

Read MoreCan I add a rear extension under permitted development in the UK?

When it comes to your rear extension and qualifying for permitted development, there are several rules you need to understand before you start cons...

Read MoreA guide to permitted development rights in 2023

In August of 2020, you may have heard about some changes that were made to your permitted development rights. These changes meant you could do more...

Read MoreWhat are the rules around permitted development rights in Conservation Areas?

If you’re considering undergoing a home renovation or having an extension added onto your home, it’s vital that you understand the rules and regula...

Read MorePermitted development rights and the green belt

Permitted development rights and the green belt are two terms you may have heard in passing; however, until you start a big home project, it’s unli...

Read MoreDo I need planning permission for a conservatory?

If you’re looking to add more space to your home, a conservatory is not only an effective option, but a budget friendly one too. Typically cheaper...

Read MoreLiving room design ideas

If you’re looking to renovate your living room but you’re not sure where to begin, we’re on hand to offer inspiration for your home. We explore mod...

Read MoreCosy living room ideas

© Matt Gamble When it comes to creating the ultimate comforting space in your own home, start with making your living room somewhere you’re truly ...

Read MoreCreate the perfect boho living room

If your living room is missing that special something and you’re looking for a fresh way to reimagine the space, consider giving it a boho edge. Yo...

Read MoreOpen plan living room ideas

© Matt Gamble Sometimes it can be tricky to imagine your home in any other design style than the one it’s currently in – even if you’re feeling re...

Read MoreA quick guide to luxury living room design

If you’re looking to up your living room game and introduce a touch of luxury, look no further. Whether you’re looking for sleek and stylish modern...

Read MoreMinimalist living room inspiration

If you’re drawn to a pared-back, uncluttered, clean aesthetic, minimalist design may be for you. Looking to overhaul your living space and give it ...

Read MoreRustic living room ideas

Looking to refresh your living room style with a rustic, country-living feel? Whether you live in a cottage in the sticks or a cosy flat in a city ...

Read MoreOpen plan kitchen ideas

© Chris Snook Open plan kitchens have long been a popular choice for modern homes for their airy feel and their ability to create more sociable sp...

Read MoreKitchen design ideas to transform your space

© Veronica Rodriguez Sometimes, a cliché is a cliché for a reason and we believe that’s rarely more true than when we talk about kitchens. It’s th...

Read MoreBring kitchen living room design ideas to life

© Veronica Rodriguez In recent years, open plan living has become a growing trend and a popular choice for people looking to reimagine their space...

Read MoreModern farmhouse and country kitchen ideas

Whether you live in the suburbs, city centre or in the countryside, recreate a modern farmhouse kitchen at home. If you’re not yet ready to delve i...

Read MoreCottage kitchen ideas for a touch of country living at home

© Matt Gamble Whether you truly live in a cottage or you simply want to recreate the sense of cosiness that comes with one, a cottage kitchen desi...

Read MoreLuxury modern kitchen design ideas

© Matt Gamble Looking to take your kitchen up a notch in the luxury department? It could be time to explore luxury modern kitchen design in a litt...

Read MoreAm I in a Conservation Area?

Before we let you know how to find out whether you live in a Conservation Area, it seems appropriate to clarify what a Conservation Area is. Essent...

Read MoreDo you need planning permission for building in a conservation area?

Conservation areas have notoriously convoluted rules and regulations around building and development, meaning that it can be challenging to know wh...

Read MoreCan you have solar panels in a Conservation Area?

Renewable energy is more important than ever and, in turn, the popularity of renewable energy sources such as solar panels is soaring. That being s...

Read MoreCan you build loft conversions in Conservation Areas?

If you’ve got unused attic space, a loft conversion could be a fantastic option for creating extra space in your home, offering an opportunity for ...

Read MoreWhat are the rules for your garden in a Conservation Area?

According to a recent survey we carried out, given £10,000 most people would choose to invest it in their gardens after kitchens. This suggests tha...

Read MoreA guide to extensions in Conservation Areas

Getting an extension is no mean feat at the best of times but when it comes to living in a Conservation Area the rules and regulations can be even ...

Read MoreRenovations and extensions in Conservation Areas: everything you need to know

Conservation Areas were introduced in 1967 to help manage and protect Britain’s most prized areas. Whether they stand out due to their architectura...

Read MorePlanning, design and architectural support in Woking

Looking to expand your home in Woking but not sure where to start? The renovation process can be challenging and stressful, with all the planning r...

Read MoreSurrey Heath planning application support and designers

© Chris Snook If you’re planning to extend or renovate your Surrey Heath home but the process feels a little daunting, we’re here to support you f...

Read MoreArchitectural and planning services in Southampton

Whether you’re looking for architectural or design support, planning expertise or practical surveying insights, we’ve got each step of your home re...

Read MorePlanning application support and designers in Reading

The planning and building regulation process in Reading can be tricky to navigate and it can be unclear to know where to find the right architect, ...

Read MoreMilton Keynes planning support and extension designers

Hoping to extend your Milton Keynes home but not sure where to start? From planning rules and regulations to design knowledge and budgeting, the re...

Read MorePlanning support, architects and building support in Guildford

If you’re looking to extend or renovate your home in Guildford, we have the team you need to get started. Whether it’s support with planning, creat...

Read MorePlanning support and architectural designers in Sevenoaks

Living in Sevenoaks and thinking of extending your home? Resi provides planning support and architectural designers to guide you through the whole ...

Read MorePlanning support and architectural designers in Brighton, Hove and East Sussex

If you’re looking to build an extension on your Brighton and Hove property and need planning or design advice, you’ve come to the right place. In ...

Read MoreWraparound extensions: everything you need to know about L-shaped extensions

What is a wraparound extension? Wraparound extensions take advantage of dead space towards the side of your home, as well as space to the rear o...

Read MoreCould a flat wraparound extension be for you?

Wraparound extensions, or L-shaped extensions, have been a popular choice for houses with the available space to move into for a long while now. Th...

Read MoreWraparound extension ideas to bring new life to your home

Does the time feel ripe for a home renovation? Is increasing your space the top priority on your list of improvements? If this sounds like you and ...

Read MoreA quick guide to semi-detached wraparound extensions

What is a semi-detached house? Let’s start with the basics and define exactly what a semi-detached house is. Simply put: it’s a house that shares ...

Read MoreHow much does it cost to build a wraparound extension?

A wraparound extension, unlike a standard rear addition, utilises space to the back and side of your property. Essentially, they combine both a sid...

Read MoreHow to build a single storey wraparound extension?

When it comes to extending the rear of your property, you have two classic options: rear and side. But what if you could combine the two? This is...

Read MoreAll you need to know before starting your side return extension project

Side return extensions are one of the most popular house improvements out there. They’re a great way to use up free space at the side of your house...

Read MoreSide return kitchen extension: costs and benefits

If you’re looking to renovate your home and make your kitchen the star of the show, it’s worth considering whether a side return kitchen renovation...

Read MoreHow a glass side return extension can lighten your home

There are fewer ways to invite more light into your home and really emphasise the space you’ve created with a side return extension than choosing g...

Read MoreEverything you need to know about side return extension on a Victorian terrace

If you have a Victorian terraced house and you’re looking to extend, a side return extension (sometimes referred to as a side infill) could be an e...

Read MoreSide return extension ideas to improve your home

Side extensions are one of the most popular house improvements out there. They’re a great way to use up free space at the side of your houses, enha...

Read MoreHow much does a side return extension cost?

If you have alleyway space to the side of your property and are looking to create some extra room, a side return extension might just be what you’r...

Read MoreCan I add a rear extension under permitted development in the UK?

Before construction can begin on your rear extension, if you want to qualify for permitted development, there are several rules it’s important to u...

Read MoreThe cost of a rear extension in the UK and how to save some pennies

Building a rear extension is an exciting yet often daunting prospect. Many homeowners don’t know where to start, who to talk to, or what to do firs...

Read MoreA deep dive into double-storey rear extension rules and regulations

Double-storey rear extensions are a fantastic way of maximising the space in your property. But there’s a lot of building regulation jargon to cut ...

Read MoreA beginner’s guide to pitched roof rear extensions

The space available at the back of many properties is often underused or completely wasted due to its awkward location. So, if you’re thinking abou...

Read MoreRear Extension Ideas to Add More Space to Your Home

Sometimes it’s simply not possible to find space, and it has to be made. A shift towards staying in was triggered by the pandemic, but all those ho...

Read MoreA Guide to Mid-Terrace Rear Extensions in the UK

The structure and uniform appearance of terraced houses means that they can be charming places to live in and extremely energy efficient at the bes...

Read MoreA beginner’s guide to flat roof rear extensions

Flat roof extensions are growing in popularity and can be a sleek, modern and practical way of adding more space to your property. If you’re consid...

Read MoreHow important is a party wall when it comes to semi-detached rear extensions?

If you live in a semi-detached house and are thinking of undergoing building work, it's worth considering what effect the work will have on neighbo...

Read MoreCreating your ideal bungalow rear extension

Bungalows are properties that are filled with great possibilities for renovating that you can get really creative with. If you're looking to extend...

Read MoreDo You Need Planning Permission for a Rear Extension?

Before you can get started on making your rear extension a reality, an understanding of planning permission rules is essential. Discover everything...

Read MoreThe Ultimate Guide to Rear Extensions in the UK

It’s time for a rear extension. You’ve thought long and hard about it. You’ve saved up. And now you’re ready to build the rear extension you’ve alw...

Read MoreHow do heat pumps work?

Gas and oil prices continue to rise, causing many to struggle to pay their energy bills. As there is no guarantee that bills will become cheaper, i...

Read MoreHow to install a heat pump in your house

Heat pumps are becoming a great way to heat homes in a more carbon efficient way, becoming high on the list of priorities for potential UK homeowne...

Read MoreHow much does a heat pump cost?

Heat pumps are steadily garnering more attention across the UK as a potential way to combat rising energy costs. Despite this, many UK households a...

Read MoreWhat is a ground source heat pump and how does it work?

Heat pumps are becoming cheaper and more efficient thanks to developing technologies, steadily making them a viable alternative to oil and gas heat...

Read MoreWhat’s an air source heat pump and how does it work?

Over the past year, gas prices have risen, making energy bills unaffordable for many UK households. Since there seems to be no guarantee that energ...

Read MoreA comprehensive guide to heat pumps

Most UK households get their hot water and heating from boilers, but these are notoriously unreliable appliances. And with the current exponential ...

Read MoreHow much do solar panels cost in the UK?

With increasing demand for green energy in UK households, solar panels have become a great option for producing renewable energy. But despite the m...

Read MoreThe complete list of solar panel grants in the UK and how to apply

Solar panels are becoming an increasingly common option for UK households, giving people the option to produce their own green energy. One issue th...

Read MoreHow do solar panels work?

With the exponential rise of energy costs and increasing demand for sustainable energy throughout the UK and Europe, solar energy’s appeal has skyr...

Read MoreHow efficient are solar panels?

With increasing awareness about climate change and soaring energy bill costs, renewable energies have been pushed to the forefront as a viable solu...

Read MoreThe Buyer’s Guide to Solar Panel Battery Storage

In recent years, solar panels with battery storage have become more widespread for domestic use in the UK. Since batteries for solar panels are sti...

Read MoreOur guide to installing solar panels

More and more households in the UK are turning towards solar panels for their energy production. Over 3,000 installations are being carried out eac...

Read MoreSolar panels for your UK home: everything you need to know

Demand for solar panels for UK households has grown exponentially in the past decade, and even more in the past few months. With lower manufacturin...

Read MoreEnergy Efficiency Grants in the UK and How to apply

We are all feeling the full brunt of rising energy prices at the moment. Your energy bill has soared and you are probably wondering how to reduce i...

Read MoreA guide to the Green Homes Grant and the projects it covers

Back in July 2020, the Government announced a new scheme to get homeowners making more energy-saving improvements. But what exactly does this Green...

Read MoreHow changing EPC regulations could impact you

Whether you’re a homeowner, landlord or a private tenant, it’s really important that you’re aware of recent changes to EPC requirements and how the...

Read MoreEverything You Need to Know About Energy Efficiency

With energy prices at a record high and more potential rises possible in the months to come, now is a good time to start thinking about the energy ...

Read MoreHow to keep your house cool - keep cool ideas for home

Thanks to the typical weather in the UK (it’s a cliche for a reason!), we rarely think about how our homes respond to summer until it’s scorching o...

Read MoreHome ventilation is just as important as insulation – a deep dive into the why & how.

© Matt Gamble Insulation is rarely absent from conversations about home improvement. But home ventilation is all too often overlooked and its impo...

Read MoreRetrofit for next winter now – yes, while it’s spring!

The sun has just about peered out from behind the clouds and it’s not freezing… all the time? Yet we’re suggesting that it’s time for you to start ...

Read MoreEPC Rating: Improve Your Home’s Energy Efficiency

If you’re looking to buy, sell or rent a home, then you’ve probably already come across the term EPC, maybe without even knowing what it stands for...

Read MoreAn exploration of reliable homes – how your home can support you through major life changes

Your home should be a haven through the ups and downs of life. Successfully reliable homes should be able to offer retreat when times are tough. Wh...

Read MoreHow to make home living more energy efficient

Achieving energy efficiency in the home doesn’t have to be a slog. We explore the myriad ways you can reduce your footprint and minimise your bills...

Read MoreHow to check your home’s insulation in 2023

When the temperatures drop and a storm usually named with a pun by the media rolls in, your home can feel like a cryogenic chamber rather than a re...

Read MoreHow to Make Your Home's Appliances Energy Efficient

In these particular times of exponential inflation and increase in prices of raw materials, we are more than ever exposed to inflated energy bills....

Read MoreResi’s Retrofit Hub

1. Introduction from Mark Hood, our Head of Architecture 2. What does retrofitting mean? Retrofitting, in essence, upgrades your home'...

Read MoreHow much does a garage conversion cost?

If you are looking to create some space at home and are happy to part with your garage, then a garage conversion might be the ideal project for you...

Read MoreDo you need planning permission for your garage extension?

Whether you’re extending your garage on the ground floor or adding a new storey on top, there will be one thing on your mind: will I be able to get...

Read MoreHow to build an extension over your garage

Adding a new extension above your garage isn’t the most common project in the UK, so if you’re tackling this project yourself, it can feel a little...

Read More5 steps to build a beautiful side garage extension

If you’re looking to take your garage to the next level, then a side extension might be just the ticket. For certain properties, a side extension c...

Read More10 garage extension ideas to create more space in your house

One of the reasons why so many people are opting for a garage extension is the versatility of the space. Extend above your garage and you could hav...

Read MoreGarage extension: the how-to guide for UK homeowners

There are many reasons why a homeowner might consider a garage extension. The number one benefit being is they’re highly versatile. You might choos...

Read MoreWhat is the cost of an extension over a garage?

You’ve been looking at your garage and you’ve noticed there’s room for improvement. Specifically, you think a new extension on top of the garage wo...

Read MoreWhat are the benefits of remortgaging?

Remortgaging your home involves moving your current mortgage from one lender to another, or from one product to another with the same lender. Switc...

Read MoreBuy-to-let remortgaging explained

If you’re currently on a traditional mortgage and you want to remortgage over to a buy-to-let mortgage, then it helps to know the ins and outs of t...

Read MoreRemortgaging: everything you need to know

Something people ask us a lot is: should I remortgage? And it’s a very good question to ask! Very rarely do you take out a mortgage and stick with...

Read MoreHow much does a remortgage cost? The fees you should be aware of

There are lots of potential benefits to remortgaging, like saving money on your mortgage payments, but how much does a remortgage cost? Remortgage ...

Read MoreHow to remortgage for home improvements and extensions in the UK

Are you feeling like renovating your home this year? Possibly a new kitchen or a loft conversion? Or even just a new bathroom? Your remortgage can ...

Read MoreHouse valuation for a remortgage: what to expect in the UK

If you are thinking about remortgaging, it is always a good idea to get your house valued first. A remortgage valuation gives you an indication of ...

Read MoreHow to remortgage in the UK: a step by step process

You might know about the benefits of remortgaging, like potentially saving money on your monthly mortgage payments and releasing equity to fund hom...

Read MoreRemortgage advice: what you should know and the questions to ask when mortgaging

Remortgaging is where you switch the mortgage on your current home to another lender or to a different mortgage rate. It basically means replacing ...

Read MoreCan you remortgage to buy another property?

You are wondering if you can remortgage to buy another property? Of course! Are you thinking of a buy-to-let investment? Or possibly a holiday home...

Read MoreBuild your very own outdoor pizzeria

Nothing quite says summer like al fresco dining and, if you’re lucky enough to have a home with a garden, making your outdoor space shine is the ne...

Read MoreGarden room extensions: your guide to interior design

Decorating the interior of your garden room is the cherry-on-top step of creating the room of your dreams, and it is the perfect opportunity to fle...

Read MoreAre garden rooms the secret to a perfect home office?

Hybrid working is here to stay. With less emphasis on office or in-person hours in favour of time on the clock, many of us need our homes to be abl...

Read MoreHow to convert a garage into a garden room

One of the most cost-effective ways to add a garden room extension is to work with a pre-existing structure. A detached garage makes a perfect cand...

Read MoreA guide to building an underground basement extension beneath your garden

One of the most underutilised spaces, often overlooked by homeowners, is the space underneath your garden or driveway. And this can be a mistake be...

Read MoreGarden room extension cost: breakdown and ideas to keep it under control

A garden room is more than an extension of your home, the multitude of design options and features available can make it an extension of you and yo...

Read MoreGarden room extension ideas to get you thinking

You might find yourself wondering: what is a garden room? Garden rooms are a cost-effective and simple option for adding value, style, and space t...

Read MoreGarden room extensions: the ultimate homeowner guide

Sometimes it can be hard to carve out some personal space in our homes. Whether this is because of noisy children bursting into your home office, o...

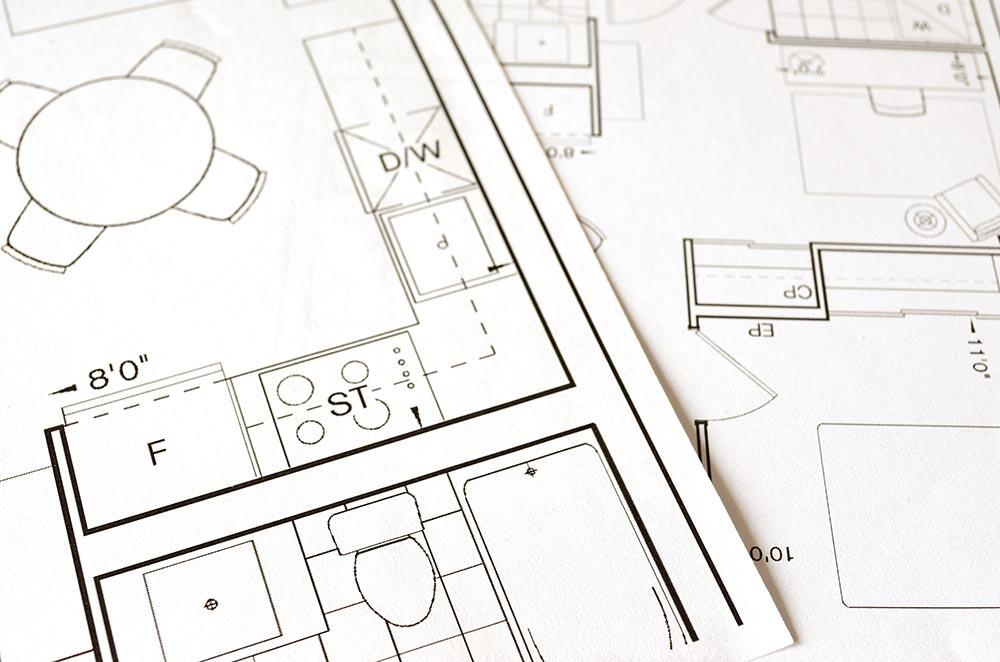

Read MoreHouse extension drawings: types of designs and house extension plans you need

While the idea of decorating your new extension might be exciting, there are a couple of vital steps you must take before arriving at that point. O...

Read More5 pitfalls to avoid when extending your house

Extending your home is a big project. Second to actually buying your home, it’s going to be one of the biggest financial commitments you’re likely ...

Read MoreDo you need an architect for a house extension?

Is it illegal to build an extension without an architect involved? No. However, just because architects aren’t a legal requirement, it doesn’t me...

Read More5 more questions to ask your architect

Not too long ago, we shared with you the top five questions you should be asking your architect. Now we’re back, giving you more important question...

Read More7 tips to keep house extension costs down

There are two simple tips that will always save you money during a building project: don’t cut corners and do your homework. Here are 7 things yo...

Read More5 things you need to know about house extension and timings

We’ve worked with a lot of homeowners - over 2000, in fact - and if there’s one thing that shocks people the most about remodelling it’s the time i...

Read MoreHow much money can DIY save you on your house extension?

If you’re looking to save money on extended your home, look no further - DIY is the answer! By taking on a few of the basic handy jobs, you could ...

Read MoreHow to build an energy efficient house extension

Once the domain of hippies and guys named Dreadlock Dan, becoming energy efficient is now mainstream - especially for homeowners. Not only does it ...

Read More5 key questions to ask your house extension architect

Figuring out how to choose an architect for your home building can be tough. However, getting the right architect is even tougher, which is why it'...

Read MoreWhat's the best order to build your house extension: top down or ground up?

Question: We’ve recently purchased a semi-detached terrace house. We know that we’d like to add both a loft conversion and a ground floor extensio...

Read MoreA guide to flat-pack extensions

With the price of stamp duty hammering homeowners, not enough homes on the market, and unstable house prices, more and more people are choosing imp...

Read More10 things you need to know about glass roofs

If there’s one thing that can truly give your home the WOW factor, it’s a glass roof. Not only are they visually stunning, but they can also transf...

Read MoreHow much does an extra bathroom add to the value of a house?

Typically, bathrooms have the potential to add between 4-5% onto your home’s value. But this can go up or down, depending on how you execute your d...

Read MoreHow close can you build your extension to your neighbours' boundary?

© Matt Gamble When it comes to building a house extension, it’s vital to establish whether you share a Party Wall with your neighbours. Depending ...

Read MoreExtension ideas for growing your family home

Growing your family home doesn’t carry all the same connotations it once did. The pitter-patter of tiny feet still calls for adaptations to be made...

Read MoreHow to build your ideal gym at home

All too often with our increasingly hectic lives, it can feel almost impossible to find time to hit the gym, unless you’re prepared to wake up at a...

Read MoreEverything you need to know about granny annexes

Granny annexes have boomed in popularity in recent years. But where do their origins lie and why have they taken off? We dive into the history of t...

Read MoreThe types of house extensions: design and ideas

If you need bigger living quarters but would rather not move out of your present home, you should consider adding an extension instead. Adding an ...

Read MoreThe process to building an extension

© Matt Gamble Building an extension isn’t a walk in the park but the rewards that come with renovating your home can be transformative. Knowing wh...

Read MoreTerraced house extension: design, cost, regulations and ideas

Although terraced houses are common in the UK, they tend to get a bad reputation, with many assuming they offer little in the way of space and styl...

Read MoreHouse extension without planning permission: what are the rules?

In case you've been wondering, yes, it's possible to build a house extension without planning permission — and it’s all thanks to permitted develop...

Read MoreTwo-storey extensions: costs and planning

If you’re someone who doesn’t like to do things by half measures, you might be considering a two-storey extension. While they seem dramatic, there...

Read MoreHouse extensions: everything a homeowner needs to know

Why move when you can improve? With a home extension, you can get the space you need, while also being able to stay in the area you love. What’s mo...

Read MoreYour guide to building a Happy Home through life changes

Life changing is one of the great inevitabilities but your home, if you’re lucky, will remain a constant feature. A constant, yet shape-shifting fe...

Read MoreHas the social kitchen made the living room redundant?

© Matt Gamble The way that we live in our homes has transformed over time – even in the past few years, many of us have adapted to new patterns of...

Read MoreLoft conversion vs extension

Both loft conversions and extensions can create an extra room in your home. However, there are differences between these two constructions and unde...

Read MoreHouse front extensions: costs, planning and tips

If you need more living quarters and have some extra space at the front of your house, why not consider installing a house front extension? House ...

Read MoreHouse extension cost: how to budget for your project

Those looking to improve where they live have many options, but none have proven to be as popular as extending. With the increased desire for spaci...

Read MoreThe ultimate guide to garage conversions

Is your garage going to waste? Perhaps over the years, it’s become less a place to park your car, more a place to park all that junk you don’t wa...

Read MoreConverting your garage into a home gym

Are you a gym bunny, or someone looking for a serious kick in the fitness bum? If so, you might be considering installing your very own home gym. ...

Read MoreBig interior design mistakes to avoid when planning a house extension

Deciding to extend your home is never a decision to be taken lightly. The process can be stressful thanks to the immense number of decisions involv...

Read MoreCan I add an extension to a listed building?

Living in a listed building is a great privilege, but it can be limiting if you decide you’d like to add more space through a house extension or lo...

Read MoreThe benefits (and pitfalls) of undertaking a house extension with a neighbour

Neighbours can get a bad reputation in the home extension game. You hear classic horror stories about the nightmare family next door, of vicious pa...

Read MoreWhat are the rules on house extensions?

We won’t lie to you, there are quite a few rules when it comes to building an extension, but this doesn’t have to put you off. Like any game, once ...

Read MoreCould you build your own roof terrace?

After the events of 2020, there’s one thing everyone wants - gardens! In fact, the more green space, the better. And there’s a good reason for this...

Read MoreHow to build a glass extension on a listed building

Whether you’ve bought, inherited, or are considering a listed building, many assume these protected buildings can’t enjoy modern extensions other h...

Read MoreHow long does a house extension take?

Full disclosure: there’s no guaranteed timeline for any residential extension project. Depending on the size and scope of your extension, the lengt...

Read MoreHow to get the drainage right for your house extension

Drains aren’t the most glamorous side of extending your home, yet that doesn’t make them any less important. From the logistics of a larger roof co...

Read MoreWhat’s the difference between a first and second fix?

If you’re planning any kind of house extension or loft conversion, you’ve probably heard someone using the terms "first fix" and "second fix", but ...

Read MoreHow to get freeholder consent for a house extension

If you own the freehold of your building, you have the right to carry out any building work that you like on your property (as long as it adheres t...

Read MoreEverything you need to know about basement conversions

So you’re considering a basement conversion, but not 100% sure whether your home is suitable, or if the end results are going to be right for your ...

Read MoreSemi-detached house extensions: design, cost, regulations, and ideas

Semi-detached house extensions allow you to add that much-needed space to your home. However, they can be pretty tricky due to the adjoining wall y...

Read MoreHow much does it cost to build a granny flat

Homes are changing and one big change is the rise of multi-generational homes. Either through adult children living at home, or older relatives nee...

Read MoreWhat's the best way of financing a house extension?

When it comes to financing your project, whether it’s an extension, conversion, or renovation, it can be difficult to know which route will be best...

Read MoreA guide to extending your maisonette

Just because you live in a maisonette, doesn’t mean you don’t have options. In fact, extending this house type has never been more popular. With ...

Read MoreHouse extension guide: how to extend your home

When it comes to making space at home, you can’t beat an extension. The space they create is regularly used for additional bedrooms, ensuite bathro...

Read MoreHouse extensions: 15 things everyone needs to know

Before you embark on extending your home, there are a few things every homeowner should sit down and consider. After all, even modest additions are...

Read MoreBarn conversions guide: planning permission and costs

Is there any project more quiescently British than a barn conversion? With their high ceilings, rustic beams, and general country-ness, who wouldn’...

Read MoreHouse side extensions: design ideas, planning, and costs

Homeowners with extra space at the side of their homes looking to expand their living quarters will benefit from installing house side extensions. ...

Read MoreWhat kind of survey do I need for my house extension?

Surveys don’t get talked about nearly enough. As one of the first steps on your renovation journey, they provide the foundation for all the work th...

Read MoreGarden Rooms: the essential guide to creating your own

A garden room is a great way to get more usable space at home. Whether you need a home office, a place for the kids to hang out or a base for your ...

Read MoreDo conservatories add value to your house?

The conservatory - it’s a British classic. Despite being a rain drenched, cloudy isle, our eternal optimism for sunshine has made conservatories on...

Read More5 single storey extension ideas for your home (on a budget)

When it comes to expanding your home, a single storey extension is one of the most popular ways of achieving this. Most commonly, they’re used to e...

Read MoreSingle storey extension ideas under £30,000

When it comes to extending your home, you don’t have to break the bank to get amazing results. While some single-storey extensions can cost upwards...

Read MoreSingle storey extension costs: what you need to know

It helps to have a comprehensive idea of how much extensions cost before embarking on any extension project - and single storey ones are no differe...

Read MoreSingle storey rear extension: the ultimate guide for UK homeowners

Adding a single storey rear extension presents a great alternative to moving house while adding value and personal style to your home. They’re per...

Read MoreSingle storey side extensions: everything you need to know

If you’re thinking of increasing the living space in your home and you’ve some extra land on the side, it’s worth considering a single storey side ...

Read MoreSingle storey bungalow extensions: a UK homeowner guide

A single storey bungalow extension offers a lot of potentials to fit different lifestyles. With a bungalow, you can increase floor space or room si...

Read MoreWhat is the ideal depth of foundations for my single storey extension?

Although unseen by the naked eye, foundations are one of the most vital components of any building. They are the base carrying the weight of the st...

Read MoreDo you need planning permission for a single storey extension?

When embarking on any building project, the question of planning permission is bound to come up at some point. While the entire concept of planning...

Read MorePitched roof single storey extension: is it right for your home?

A single storey extension is an excellent way to bring to life your desire for more home space without moving house. As much as you would love to ...

Read MoreSingle storey extensions: the ultimate guide for homeowners

They’re versatile, come in a range of shapes and sizes, can be tailored to varying budgets, and they can help transform the layout of your home. Ye...

Read MoreFlat roof single storey extension: everything you need to know

As time flies, your family’s needs change, and you might find that you need more space in your home. Instead of moving to satisfy that need, you sh...

Read More5 kitchen renovation ideas to make your home look (even) better

If you’re looking for kitchen renovation ideas, you’ve come to the right place! We’ve created plans for hundreds of kitchens over the last few yea...

Read MoreKitchen renovations to get you hungry for more!

Is the kitchen the heart of your home? A communal hub of romantic dinners, Sunday lunches, and feasts with friends? If so, make this the year you g...

Read MoreThe best flooring options for your kitchen: a guide for UK homeowners

Whether you’re looking to fully refurbish your kitchen, or just to give your floor a makeover, what material you choose can have a big impact on th...

Read MoreHow much does a kitchen extension cost?

Often referred to as the heart of the home, it’s no wonder kitchen extensions are one of our most commonly received requests. Not only do they open...

Read More10 pitfalls to avoid when designing a new kitchen

If you’re looking for a way to breathe new life into your home, nothing is more invigorating than a brand new kitchen. When your kitchen is at it’...

Read MoreAdvantages and disadvantages of bifold doors on your kitchen extension

If you’re looking to extend your kitchen, there are a number of design decisions to make to achieve your desired space, and one of those all-import...

Read MoreKitchen garden room extensions: how to create your own

Typically built with a solid roof, garden rooms differ in style from an orangery or conservatory kitchen extension. However, they still possess the...

Read More5 industrial kitchen design ideas to give your home a modern look

When it comes to kitchen trends, no style is having more of a moment than the industrial model. Whether you want sleek modern finishes, or rustic t...

Read More10 kitchen diner design ideas and inspirations

Let’s start with a quick history lesson. Following the end of WWII, the kitchen underwent a major renovation. Before it was a space to be hidden a...

Read MorePitched roof kitchen extensions

If you need a bigger kitchen to entertain more guests or are just a lover of large spaces and, in particular, large kitchens, then pitched roof kit...

Read MoreSmall kitchen extension ideas for 2023

Are you looking for small kitchen extension ideas for 2023? Then you’ve come to the right place. Make no mistake, you can get a lot of value out o...

Read MoreGlass kitchen extension ideas

© Veronica Rodriguez Glass kitchen extensions are a sleek, natural-light-inviting renovation option that can totally transform your space. We look...

Read MoreA window into open plan kitchen extensions

© Matt Gamble Open plan kitchen extensions are some of the most popular types of renovation in the present day. We take a look into what exactly t...

Read MoreKitchen diner extension ideas: what to consider

© Matt Gamble The kitchen diner extension is one of the most popular renovation paths for UK homeowners. We explore what makes it such an appealin...

Read More7 things to consider when building a kitchen conservatory extension

Building a conservatory is a popular way to expand your kitchen while flooding it with natural light. The ample natural light and ability to seamle...

Read MoreHow to build an orangery kitchen extension: rules, planning and design

Orangery kitchen extensions are a fantastic way to increase your living space while incorporating floods of natural light into your home, and make ...

Read MoreHow to build the perfect skylight kitchen extension

Thinking of adding a skylight kitchen extension to your home? Great idea! Installing a rooflight extension allows you to expand your kitchen so tha...

Read MoreFlat roof kitchen extensions

When planning your kitchen extension, it’s essential you consider the roof type that best suits your budget and aesthetic goals. Flat roof kitchen ...

Read More5 design tips for creating a modern wooden kitchen

What comes to mind when you think ‘modern kitchen’? No doubt you’re picturing sleek countertops and shiny metallic appliances. However, modern does...

Read MoreKitchen extensions: the ultimate guide for UK homeowners

One of the most popular residential projects in the UK is the kitchen extension - and it’s easy to see why! Whether it’s opening up space for a kit...

Read More6 country style kitchen ideas for UK homeowners

Old country kitchens were once the driving force of day-to-day working lives. Hungry and industrious land workers would stop to socialise and refue...

Read MoreTips on designing a family-friendly kitchen

We’re often told the heart of the home is the kitchen, but for many families, this doesn’t always turn out to be true. Kitchens can either be a sou...

Read MoreChoosing the right kitchen countertops

When it comes to choosing the right kitchen countertops, it can be difficult to sort through all the options on offer. Kitchen countertops can var...

Read MoreDesigning the home cook's dream kitchen

Flick through the television schedule and it’s impossible to ignore the fact we’re a nation of foodies. Whether you like to keep things traditional...

Read MoreSoak up more sun with a garden room

Summer is finally on the horizon and in the presence of warmer weather we’re now all feeling a little more reflective of how we enjoy our homes thr...

Read MoreEverything you need to know about porcelain patios

They’re strong, look great, and can be easily maintained, so it’s easy to see why porcelain patios have been surging in popularity. However, is thi...

Read MoreEntering our garden era

Gardens seemingly reached the peak of their popularity at the height of heatwave lockdown. So it came as no surprise to us that when we asked peopl...

Read MoreConservatories and orangeries to appreciate the change in seasons

There’s plenty to be enjoyed outdoors as the seasons change. Spring brings with it a boost of light and freshness that leads us to the heady, brigh...

Read MoreFive tips for growing your own food at home

There’s no denying that, thanks to lockdown, gardening is back in vogue, especially when it comes to growing your own food. If want to take a bite ...

Read MoreA guide to arboricultural services and why you need them

There are a lot of difficult terms to get your head around as a homeowner and ‘arboricultural’ is a pretty good example of this. Yes, the housing i...

Read MoreIntroducing our new partnership with the Mortgage Advice Bureau

When you have good news that you want to share, it can be hard to keep it to yourself. That’s why it’s been so tough these last few months for our ...

Read MoreThe best time for sorting out your finance when remodelling

It goes without saying that transforming your home becomes a lot harder when you don’t have the proper finance in place. That being said, few peop...

Read MoreWhat type of finance do you need for home improvements?

When it comes to those big home improvements, it can be difficult to know where to start when it comes to financing the project. Often, as a resu...

Read MoreJuggling the costs of a house renovation

© Chris Snook The cost of a house renovation or extension is one of the most intimidating factors when it comes to undergoing a project. In fact, ...

Read More5 finance rules to follow when buying a home to renovate

When buying a new home, it’s common for renovations to be at the back of your mind. Perhaps you’re looking for a challenge and want to transform a ...

Read MoreGetting a mortgage with a low credit score

Banks and building societies are careful who they lend money to (understandably!) and so you should be prepared to have your financial history care...

Read MoreOur top home finance tips to consider before summer

The days are getting longer again and summer is finally on the way! Before the summer festivities begin, it might be a good idea to get your financ...

Read MoreHow you can use the equity in your home to fund your project

When it comes to extending or renovating your home, many believe the only way to achieve their project is through the long slog of saving. However,...

Read MoreDifferent types of mortgages explained

If choosing the right mortgage type is making your head hurt, then don’t worry, you’re not the only one. With so many different types of mortgages...

Read MoreTaking care of your money and your mental health

According to a recent survey of 10,000 employees by Salaryfinance.com, 40% of UK employees have money worries. This results in them being over eigh...

Read MoreWhat is a green mortgage?

You’ve heard of fixed rate mortgages, tracker mortgages, and discount mortgages. But what is a green mortgage? In this article, we explain everythi...

Read MoreHow to get a mortgage on your own

If you’re buying a home on one salary, either as a one-income family or as a single applicant, you might be thinking that your options are limited,...

Read MoreThe difference having a specialist lender can make

Let’s talk finance. When it comes to making significant changes to your home, either through an extension or renovation, it’s likely you’re going...

Read More5 reasons why homeowners experience budget disaster

If you’ve ever watched a show about home extension/renovation, you’ll no doubt of seen an episode where the family experience a budget meltdown. Co...

Read MoreA guide to working out the total cost of your project

How much is your project going to cost? It’s likely going to be the big question hanging in the air and one a lot of homeowners struggle to answer....

Read MoreHow much does it cost to build a conservatory

They’re one of the most popular additions for British homes but how much will a conservatory set you back? On average, a conservatory can cost any...

Read MoreHow to become mortgage-free

To live the rest of your life without having to worry about mortgage repayments – it’s the dream every homeowner works towards. So, how does someo...

Read MoreHow to save money to buy a house

The upside to saving is not only will you have a sizeable deposit when you come to buying your house, but you will also be able to demonstrate to l...

Read MoreA guide to mortgages and moving house

Moving to pastures new is an exciting prospect, but how should you get the ball rolling? Whether you’re a growing family or retiring to the country...

Read MoreCan a student get a mortgage?

Are you feeling bogged down by paying a landlord for the bare minimum? Why not consider becoming your own landlord by taking out a student mortgage...

Read MoreWhen is the best time to pay off a Help to Buy loan?

Help to Buy loans are a great way for people to get on to the property ladder who would otherwise struggle to afford a house deposit, but it can be...

Read MoreWhat is income protection insurance?

The question to ask yourself is, could you cope? If you lost your wage, would you still be able to pay the mortgage repayments, the household bills...

Read More7 things to know when buying your first home

When it comes to the house-buying process, we think every first time buyer would agree that it’s one big learning curve, from beginning to end. Th...

Read MoreWhen is the best time to pay off a Help to Buy loan?

Help to Buy loans are a great way for people to get on to the property ladder who would otherwise struggle to afford a house. While many people ha...

Read MoreWhat is buildings and contents insurance?

If you own your own home, whether it’s a two-bedroom flat or a four-bed detached property, you’ll need to have buildings insurance in place to ensu...

Read MoreIs buy-to-let still a good investment in 2022?

Whilst today’s low-interest rates might not be good news for any savers out there, on the flip side, this is great news for those looking to invest...

Read MoreShould you invest in a buy-to-let property?

When looking for a smart investment, many turn to the buy-to-let market. However, just because this can be lucrative for some, doesn’t mean you sho...

Read MoreWhat is a gifted deposit?

It’s been reported that a huge 80% of first time buyers get financial help from their parents when it comes to buying their first house. This is of...

Read MoreHow does maternity leave affect remortgaging?

Remortgaging whilst on maternity leave can cause confusion and worry if you’re not sure how to approach this, so we’re going to run through why thi...

Read MoreBuying a new build? Here’s everything you need to know

Are you considering buying a new build home? Then you’ll want to do your research: from finding out about the schemes that could help you buy a new...

Read MoreWhen not to remortgage

Knowing when the right time to remortgage can sometimes be tricky. You might have heard your friends talking about how they remortgaged the house a...

Read MoreA guide to home improvement grants in 2021

Wouldn’t it be great if someone stepped in to cover the cost of those most vital home improvements? Whether this is making your home more energy-ef...

Read MoreBuying a house with cash: pros and cons

When buying a house, there are two different ways you can go about paying for it. You can either take out a mortgage where you pay a deposit and th...

Read MoreWhat is let-to-buy?

Do you want to buy a new home without selling your current home first? Then let-to-buy might be the answer for you. Here’s everything you need to k...

Read MoreBuying, selling and moving house during lockdown

In lockdown, our homes have become more important than ever, often feeling like our whole world. But what happens when your home isn’t up to scratc...

Read MoreA guide to homebuyer surveys

Often, major structural issues aren’t easy to spot unless you’re a trained professional, so having a survey carried out on a property you’re buying...

Read MoreWhat is financial protection?

“Protection” refers to types of life and protection insurance which are put in place to help “protect” you, your income, your home or your family f...

Read MoreTop 5 ways to avoid landlord fines

As national lettings legislation has tightened up and local authorities have been given greater powers to regulate the private rented sector in the...

Read MoreBusting the myth of the big deposit

There is a bit of a secret when it comes to getting on the property ladder that many people don’t know about. And it’s all to do with what many see...

Read MoreDo you need life insurance to get a mortgage?

You’ve had your offer accepted on the house you want to buy, and you’ve just had confirmation of your mortgage approval (great news!), so now all t...

Read MoreFirst-time buyer stamp duty rules

The below article was written to reflect the Stamp Duty policy from 1st July 2021. As a first-time buyer, there are plenty of costs you need to gr...

Read MoreBuying a house with cash

You can buy a house with cash, providing you have the funds upfront to hand over to the seller. But like anything, it comes with its own advantages...

Read MoreCan I remortgage my house to buy another property?

Does the prospect of owning a second house appeal to you? Daydreams of holiday homes, or perhaps a nice buy-to-let investment? Well, now could be t...

Read MoreMortgage bankers vs mortgage brokers: why use a mortgage broker?

Most people assume that getting a mortgage means heading straight to your bank or building society, but unfortunately this can mean missing out on ...

Read MoreWhat is mortgage payment protection insurance?

The last year has been difficult for all of us but has also showed us how important it is to be protected, just in case. One way to feel more prote...

Read MoreWhat are Help to Buy Equity Loans?

Launched by the government in 2013, Help to Buy Equity Loans are aimed at helping those who are struggling to get on the property ladder. There ar...

Read MoreWhat is shared ownership?

Are you thinking about owning your own home, but only have a small deposit? Then shared ownership could be the answer... What is shared ownership?...

Read MoreStamp Duty Holiday: what does the extension mean?

The Stamp Duty Land Tax Holiday has been extended to 30th June 2021. This is an extension from the previous deadline of 31st March 2021. From 30th ...

Read MoreWhat is a 95% mortgage?

They disappeared during the pandemic but they're now back on the market - it’s the 95% mortgage. Whether you’re looking for a way of purchasing you...

Read MoreMoney saving tips for building a house

If you’re braving the exciting world of house building, the prospect of the money involved might feel a little daunting. After all, it seems like e...

Read MoreTop 10 things to consider when building your own home

When it comes to building your own home, it pays to do your homework. No doubt, this is why you’re here. If you’re looking for some practical tips ...

Read More5 pitfalls to avoid when building your own home

Building a house is a great way to ensure you get everything you want and need from your home. However, as any Grand Designs fan will know, house b...

Read MoreHow to finance building your own home

Many of us dream of building our own home but often this can feel like a distant fantasy. However, you don’t need to be a millionaire to get your h...

Read MoreHow much does it cost to build a house?

While they’re by no means a small undertaking, building a home from scratch can be one of the most rewarding things you do. You’ll have complete co...

Read MoreMeet the teams: New Builds

At Resi, we have a wide variety of specialist teams here to guide you through each stage of your architectural project that includes… Measured su...

Read MoreCan you build a house in London?

Short answer: yes! Even though London has a reputation for being tight on space, there’s no reason why you can’t still build the home of your drea...

Read MoreA guide to buying land in the UK

There are few things as rewarding as building your own home from scratch - or more daunting. One of the first challenges to your journey will be f...

Read MoreLoft Conversions in South East and South West London

If you live in South East or South West London and have an attic, you could benefit from a loft conversion to expand the space in your home and pot...

Read MoreThe complete loft conversion guide for UK homeowners

There are plenty of good reasons why loft conversions are one of Britain’s most loved home extension projects. By getting previously dead space wo...

Read MoreA guide to loft conversions and planning

Whether you plan on converting your loft into a bedroom, study, or new bathroom, you’ll need to consider which area of planning your project falls ...

Read MoreHow to do a loft conversion

A loft conversion is a great way to add space and value to your home. Whether you’re angling for an ensuite master bedroom, a kid’s playroom, a sty...

Read MoreHow much does a loft conversion cost in the UK: breakdown and tips

No matter what project you undertake, working out the costs involved are always going to be high on the agenda - and loft conversions are no except...

Read MoreDo loft conversions add value to your house?

You're ready to make the commitment into expanding your home, and have a lot of space to play with, but which project is right for your home? Like ...

Read MoreA guide to insulating your loft

It’s easy to forget about your loft, especially if it’s inaccessible or only used as a place to shove the Christmas decorations. However, with ener...

Read MoreEverything you need to know about dormer loft conversions

It’s no secret that UK homes are facing a space shortage, especially in the high demand city areas. But with not enough new homes being built, and ...

Read MoreDo you need planning permission for a loft conversion?

One of the first questions you may have when considering a loft conversion for your home is whether you need planning permission. The answer is not...

Read More9 ideas for converting your loft into a bathroom

Getting your loft bathroom right can feel like a challenge. These rooms are often smaller than others in the house, as well as sometimes suffer awk...

Read MoreHow not to mess up your loft conversion stairs

When it comes to converting your loft, you’ve no doubt got a lot of exciting things on your shopping list. The windows! A balcony! Maybe even an en...

Read More5 loft conversion ideas for your home

Who doesn’t love a loft conversion? Not only do they add bags of value-boosting space, but they also do so without you needing to sacrifice any val...

Read More5 things to know before doing a hip to gable loft conversion

For those residing in a hip-roofed house, you might find yourself lacking the necessary head height to get the loft room of your dreams. In this sc...

Read MoreOur guide to loft conversion in North London

Do you have a loft space that exists purely to store your Christmas decorations or an old hamster cage? Often the space at the top of the house is ...

Read MoreUltimate guide to loft conversions in London

Do you have an unused attic in your London home? Do you need more space in your house? And how would it sound to increase the value of your propert...

Read MoreLoft conversion in East London: our guide

Don't know what to do with your empty attic in East London? Turn this unused space into your dream room! You will be able to increase the value of ...

Read MoreIs my house suitable for a loft conversion?

Working from the top down, loft conversions are one of the UK’s favourite ways to add new space. Could your home be the next one to join the trend?...

Read MoreLoft Conversions in Twickenham

Space is at a premium in most London homes, and Twickenham is no different. But if you have an attic or unused roof space in your home, a straightf...

Read MoreHow to nail your loft conversion in a terraced house

Living in a terraced house can get a little cramp, which is why so many people turn to their lofts as a source of new space. But what does converti...

Read MoreWhat are the building regulations for loft conversions in the UK?

No matter what loft conversion you undertake or what kind of space you want to create, there is one unavoidable step for every homeowner - building...

Read MoreHow much does it cost to convert a loft?

Loft conversions are a great way to add space and value to your home, but at what cost? This price will depend on the structure of your roof, the a...

Read MoreTypes of loft conversions

There are four main types of loft conversion found in UK homes. A loft conversion can be used as a guest bedroom, study or playroom, adding both fl...

Read MoreExploring the psychology behind tidy house, tidy mind

© Matt Gamble We’ve all heard an iteration of the expression before. If you’ve worked in an office long enough, the likelihood is you’ve received ...

Read MoreHappy Homes: making your home 'adaptable'

As part of our Happy Homes Survey, we’re taking the results our pioneering research uncovered and showing you how to apply it to your own household...

Read MoreHappy Homes: making your home feel 'secure'

As part of our Happy Homes Survey, we’re taking the results our pioneering research uncovered and showing you how to apply it to your own household...

Read MoreHappy Homes: making your home feel 'nourishing'

As part of our Happy Homes Survey, we’re taking the results our pioneering research uncovered and showing you how to apply it to your own household...

Read MoreHappy Homes: making your home 'Reflective'

As part of our Happy Homes Survey, we’re taking the results our pioneering research uncovered and showing you how to apply it to your own household...

Read MoreHappy Homes: making your home 'relaxed'

As part of our Happy Homes Survey, we’re taking the results our pioneering research uncovered and showing you how to apply it to your own household...

Read MoreHappy Homes: making your home 'sociable'

As part of our Happy Homes Survey, we’re taking the results our pioneering research uncovered and showing you how to apply it to your own household...

Read MoreWhat Makes a Happy Home? Our 2023 report reveals all

At Resi, we pride ourselves on being curious about our customers, homeowners and the UK public in general. We believe that if we understand people’...

Read MoreHow to create a home that cares for your wellbeing

At Resi, we aim to be the pioneers of wellbeing-focused home design. That’s why, in 2020, we commissioned The Science of a Happy Home report. This ...

Read MoreWhat happens after you've obtained planning permission?

Getting planning permission or a lawful development certificate can take between 8-10 weeks, so it’s good to apply early. However, once you know th...

Read MoreWhy your local authority matters when extending

If you’ve decided to take the plunge into extending your home, there’s someone (or some people) you’re going to have to become very acquainted with...

Read MoreDo I need planning permission for my flat or maisonette?

Flats and maisonettes do not fall within your permitted development rights, meaning you will have to seek planning permission for changes you want ...

Read MoreDo I need planning permission for a rear extension in the UK?

Before we tell you what you do need planning permission for when it comes to your rear extension in the UK, you might want to read our article, ‘Ca...

Read MoreDo I need an architect for planning permission?

Planning permission, if you’ve never taken on a home project before, it’s likely you’ve heard the horror stories. Tales about unruly planning offic...

Read MoreDo you need planning permission for an extension?

If you are looking to extend your home, you’ve no doubt been thinking about planning permission. Namely whether or not you will need it, the rules ...

Read MoreHow to improve your chances of a successful planning application

Securing planning permission can be one of the most nail-biting moments of your project. Will you get approval? Will those french-doors you’ve been...

Read More10 home improvements you can do without planning permission

Planning permission got you putting off that big project? Perhaps you’ve seen one too many planning nightmares in Grand Designs and have decided to...

Read MoreHow long does planning permission last?

Whether it’s because the timing isn’t right or due to external factors if you’ve obtained planning permission, you might not be ready to jump into ...

Read MoreEverything you need to know about your local authority

When it comes to extending, you’ve probably run your project past everyone you can think of. Your partner, your parents, your kids, friends, co-wor...

Read MoreA guide to home improvement in conservation areas

Conservation areas were introduced to help manage and protect Britain’s most prized areas. Whether they stand out due to their historic significanc...

Read MoreOur guide to serving a party wall notice

Whether you’re building an extension or converting your loft, if you’re undergoing a substantial renovation and have neighbours, then you might be ...

Read MoreA guide to lawful development certificates

A lawful development certificate isn’t a legal requirement, but they are incredibly worthwhile to obtain. The certificate essentially proves to bo...

Read MoreExplained: full planning, lawful development, and prior approval

Whether you’re extending or converting, there’s one word that hangs heavy over any residential project: planning. If you’ve never navigated UK pla...

Read MoreExplained: change of use and use classes

When facing the nitty gritty world of planning legislation, many homeowners can find themselves becoming lost in the jargon. No more so than with U...

Read MoreCan my architect help me if my planning permission is refused?

While having your planning application refused may feel like the end of the world at the time, hang tight! It’s not the end of your home improvemen...

Read MoreHow much does it cost to get planning permission for an extension

If you’re about to apply for planning permission to get started on your extension or renovation project, or are wondering how fees have changed ove...

Read MoreTop 10 reasons planning permission is refused

Applying for planning permission is one of the less exciting tasks involved in a home improvement project. However, homeowners need to dot the i’s ...

Read MoreHow to build an annex without planning permission

Very few people get excited about planning, and if you did most of your friends would become very concerned. But here at Resi, we do have some plan...

Read MoreDo I need planning permission?

Extending your home is an exciting and potentially value-adding project, but it can also be full of practical and administrative hurdles. One of th...

Read MorePlanning application facing rejection? Here's why you SHOULDN'T withdraw

Awaiting a planning decision can be a nerve-wracking experience, especially when you get the call saying your application will likely face rejectio...

Read MoreDo I need planning permission for a garage conversion?

Whether you’re going for a new study, gym, bedroom, or playroom, you’re probably wondering whether or not your garage conversion needs planning per...

Read MoreDo I need planning permission for an orangery?

If you’re looking to get a little more sun into your home, an orangery might be the perfect choice. However, like many construction projects, you m...

Read MoreDo you need planning permission to convert your home into flats?

Whether you’re looking to downsize your existing property or you have your eye on a ‘fixer-upper’, it’s important to know what planning requirement...

Read MoreAmending planning permission: Changes you CAN and CAN'T make after approval

Before your home improvement hopes and dreams become a reality, you need to secure the green light, thumbs up, and go ahead at various stages. Whet...

Read MoreConverting commercial buildings to residential

You see them in films, perhaps in home magazines or as part of grand TV projects - the converted building. Once a church, now a home for four. Once...

Read MoreA guide to the 'Larger Home Extension Scheme' in 2022

Back in the days before 2020, there was a planning route known as the ‘Larger Home Extension Scheme’, which allowed homeowners to build single-stor...

Read MoreWhat are permitted development rights?

Permitted development rights are a type of general planning permission granted by Parliament. If your plans fall within certain restrictions, this ...

Read MoreHow much value does planning approval add to your house?

When it comes to selling your home, everyone is after two things: a good price, and a quick turnaround. While there are many tips for getting the ...

Read MoreWhy planning applications are facing significant delays

At Resi, we submit hundreds of planning applications each month to councils across the country. Recently, our planning team have noticed some worry...

Read MoreWhat is a pre-application and do you need it for planning?

When it comes to those big projects, you want to leave nothing to chance, especially when it comes to planning. This is where a pre-application (or...

Read MoreDesigning the ultimate personal haven for Mother's Day

Here are Resi, we’re always challenging ourselves to look at things differently. So on Mother’s Day we asked ourselves: what could architects do to...

Read More5 things to know about adding a mezzanine

First things first, what is a mezzanine? The easiest way of thinking about a mezzanine is to see them as a floating extra floor. Not big enough t...

Read MoreHow to create a garden that's wildlife-friendly all year round

Think a garden is nothing more than a place to lounge in during summer? Think again! UK gardens have the potential to be wildlife saviours, yet so...

Read MoreHow to create a garden on either a balcony or roof

Not everyone is blessed with green space, especially those living in flats or maisonettes. However, just because you’re lacking a traditional lawn,...

Read MoreCreating a home that's ready for playtime

The home plays an important role in every child’s development. It’s where they take their first steps, say their first words, and learn the joys of...

Read MoreContemporary home design inspiration for 2023

Heading into 2023 with a desire to transform your home? Perhaps you’re finding your current space a little dated. Maybe too cramped? Not enough lig...

Read MoreCreating space for older family members in your home

Inviting older relatives to join your home can be a life-enhancing experience for everyone involved, as well as posing certain challenges. Family d...

Read MoreHow to improve flow in a Victorian house?

If you own a Victorian home you’ll be familiar with their characterful nature. They come with plenty of unique and attractive features from tall ce...

Read MoreStylish & practical kitchen layout ideas

The kitchen is now the central hub of a home due to the boom in an open-plan design. It is not just the room for cooking. It is the entertaining sp...

Read MoreFrench, sliding, bi-fold - which doors are right for your extension?

Think doors are boring? Think again! If you’re undertaking a rear, side, or wraparound extension, doors can transform your entire household. Far mo...

Read MoreOpen-plan living - the perfect choice for family life?

Open-plan living seems to have a particularly strong allure for those looking to renovate family homes. According to our report into The Science of...

Read MoreThe Top Kitchen Trends for 2023

It goes without saying that a full kitchen renovation isn’t a realistic annual tradition for everyone. But whether you’re designing your dream kitc...

Read MoreHow to child-proof your home the Resi way

If you’re expecting, you’ll already be aware of just how much preparation being ready for the big day takes. We’re sure you’ve had unsolicited advi...

Read MoreModernise your Victorian living room

Use a mix of patterns and textures to create a modern look If you're looking to modernise your Victorian living room, try mixing up the patterns a...

Read More10 design tricks to create a light and bright bathroom

When designing our dream homes, the desire to create breathtaking living spaces can sometimes leave bathrooms ignored, cramped, dimly lit and wholl...

Read More7 Ways to Add More Natural Light into Your Home

Natural light is essential for our health and well-being, and it can make a huge difference in the look and feel of a home - especially now that we...

Read MoreHow to achieve a 'broken plan' home

For years the trend of open plan living has reigned supreme, yet a new contender is entering the ring - broken plan living. A twist on open plan, ...

Read MoreBroken-plan living explained

Broken-plan living is all about curating an open-plan layout to create distinctive pockets or ‘zones’ throughout your home without losing all the b...

Read MoreIndoor plant ideas for adding greenery to your home

Swiss cheese plants and devil’s ivy are now staples of inner-city homes. Their lush leaves can transform the spaces they’re in and create a sense o...

Read MoreCreating the perfect atmosphere for kitchen party pros

Julia Child famously declared, ‘A party without cake is just a meeting.’ And for those who love to host – whether it’s a kid’s birthday or a wine-s...

Read MoreModern entryway ideas - how to style yours

© Matt Gamble The entryway of your home is the first thing that guests see when they arrive and the last thing you see when you head out in the mo...

Read MoreInterior design trends 2023: get ready this summer

© Matt Gamble Some design trends stand the test of time and some last only a season. We run through some of our favourite current design trends th...

Read MoreHow to prepare a baby-friendly home without moving

If you’re expecting, preparing your home for the arrival of a little one can be one of the most intimidating factors to consider – particularly if ...

Read MoreHoliday at home - create a vacation atmosphere without leaving the house

With sunnier weather to enjoy at home, avoid the hassle of flights and enjoy the summer months holidaying at home. Follow your holiday style and di...

Read More5 home improvements you can do in a month

If you’re a busy person who has unexpectedly found themselves with a quiet month on their hands, you might be considering taking on a little home p...

Read MoreThe best bathroom features to lure in future buyers

So you’re looking to do up your bathroom, or maybe you’re adding in a new one, question is: what’s going to land you the most added value? After al...

Read MoreBest home improvement projects for your bedroom

If you’ve found yourself with some time on your hands and a little cash tucked away, why not tackle a couple home improvement projects? Not only ar...

Read More5 design ideas that'll transform your bedroom

No other room better embodies the word ‘haven’ quite like the bedroom. From cosy Sunday mornings spent with tea in hand, to those lazy afternoons w...

Read More10 garage conversion ideas

If your garage is going spare, acting like a glorified storage unit, then it could be time to get this space working harder. Garage conversions are...

Read MoreHow to design a safe (fun) home for children

When it comes to preparing for your home for kids, there’s plenty to consider. Not only do you want to make sure your home is safe for even the sm...

Read MoreHouse extension ideas: before and after photos

Are you in the mood for some home inspiration? If the answer is yes, then brace yourself for some before and after delights. While we all love to ...

Read MoreMore is More: Tips for designing a maximalist home